Banks and Investment Firms Will Spend $623 Billion on Technology Products and Services in 2022

- Banks will apply generative AI in growth areas such as fraud detection, trading prediction and risk factor modelling.

- Autonomic systems exist in a basic form as roboadvisors, but more advanced forms will emerge.

- 60% of large organisations will use one or more privacy-enhancing computation techniques by 2025.

Generative artificial intelligence (AI), autonomic systems and privacy-enhancing computation are three technology trends gaining traction in banking and investment services in 2022, according to Gartner, Inc. These trends will continue to grow over the next two to three years, contributing to growth and transformation of financial services organisations.

“While growth is the top priority, the need to manage risk, optimise costs and increase efficiency also requires new technology innovations,” said Moutusi Sau, VP Analyst at Gartner. “Generative AI enables bank CIOs to offer technology solutions to the business in pursuit of revenue growth, while autonomic systems and privacy-enhancing computation are long-term solutions that provide new options for business transformation in financial services.”

IT spending by banking and investment services firms is forecast to grow 6.1% in 2022 to $623 billion worldwide. The largest category of spending is IT services, which includes consulting and managed services and accounts for 42% of total IT spending in the sector at $264 billion. The fastest growing category is software, with spending forecast to increase by 11.5% to $149 billion.

The three emerging technologies identified by Gartner collectively contribute to goals to run, grow and transform a business and have demonstrated use cases in the banking and investment industry.

Trend 1: Generative AI

Gartner predicts that 20% of all test data for consumer-facing use cases will be synthetically generated by 2025. Generative AI learns a digital representation of artifacts from data and generates innovative new creations that are similar to the original but does not repeat it.

In banking and investment services, application of generative adversarial networks and natural language generation can be found in most scenarios for fraud detection, trading prediction, synthetic data generation and risk factor modelling. It has potential because of the ability to take personalisation to new heights.

Trend 2: Autonomic Systems

Autonomic systems are self-managed physical or software systems that learn from their environments and dynamically modify their own algorithms in real-time to optimise their behaviour in complex ecosystems. They create an agile set of technology capabilities that support new requirements and situations, optimise performance and defend against attacks without human intervention.

Currently, autonomic systems are mostly software-based in the banking context. However, humanoid robots are emerging in smart branches that are examples of hardware-based autonomous systems that cater to clients and customers. They could be applied in autonomous debt management, personal finance assistants and automated lending. Roboadvisors are essentially low-level autonomic systems, although there are still trust concerns due to their high level of automation.

Gartner predicts that by 2024, 20% of organisations that sell autonomic systems or devices will require customers to waive indemnity provisions related to their products’ learned behaviour.

Trend 3: Privacy-Enhancing Computation

Privacy-enhancing computation (PEC) secures the processing of personal data in untrusted environments — which is increasingly critical due to evolving privacy and data protection laws, as well as growing consumer concerns. It uses a variety of privacy-protection techniques to allow value to be extracted from data while still meeting compliance requirements.

Gartner predicts that 60% of large organisations will use one or more privacy-enhancing computation techniques in analytics, business intelligence or cloud computing by 2025.

Within financial services, data has an inherent role in any analytics, computing and data monetisation efforts. The adoption of PEC is on the rise in use cases like fraud analysis, intelligence operations, data sharing and anti-money-laundering.

Gartner clients can read more in The Top Strategic Technology Trends in Banking and Investment Services for 2022 and Forecast: Enterprise IT Spending for the Banking and Investment Services Market, Worldwide, 2020-2026, 1Q22 Update.

Learn about the top priorities for banking and investment CIOs in 2022 in the complimentary Gartner e-book 2022 CIO Agenda: A Banking and Investment Perspective.

Fachartikel

Studien

Drei Viertel aller DACH-Unternehmen haben jetzt CISOs – nur wird diese Rolle oft noch missverstanden

AI-Security-Report 2024 verdeutlicht: Deutsche Unternehmen sind mit Cybersecurity-Markt überfordert

Cloud-Transformation & GRC: Die Wolkendecke wird zur Superzelle

Threat Report: Anstieg der Ransomware-Vorfälle durch ERP-Kompromittierung um 400 %

Studie zu PKI und Post-Quanten-Kryptographie verdeutlicht wachsenden Bedarf an digitalem Vertrauen bei DACH-Organisationen

Whitepaper

Unter4Ohren

Datenklassifizierung: Sicherheit, Konformität und Kontrolle

Die Rolle der KI in der IT-Sicherheit

CrowdStrike Global Threat Report 2024 – Einblicke in die aktuelle Bedrohungslandschaft

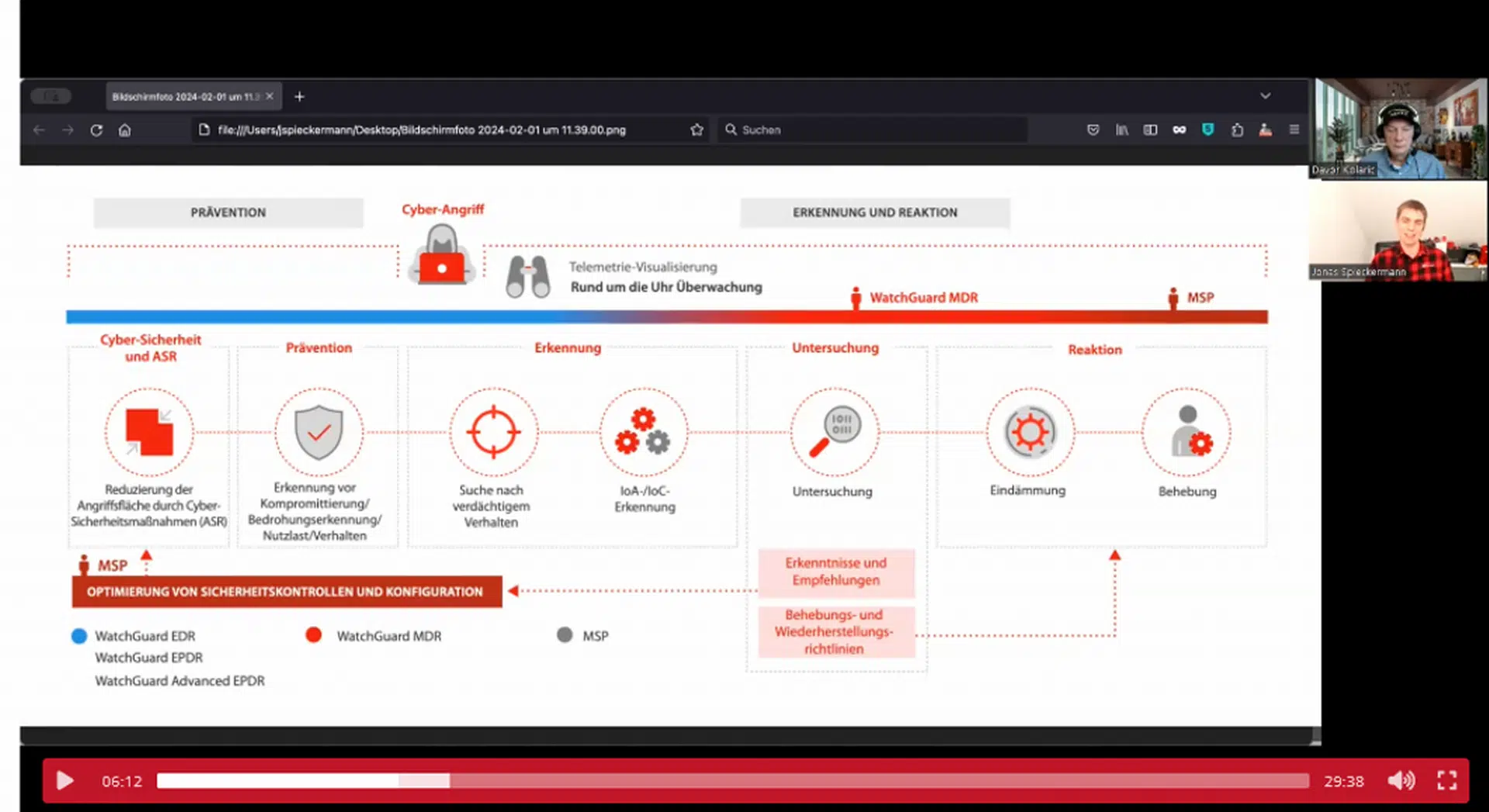

WatchGuard Managed Detection & Response – Erkennung und Reaktion rund um die Uhr ohne Mehraufwand