Rates of Inflation, Geopolitical Disruption and Talent Shortages Not Expected to Slow IT Investments

Worldwide IT spending is projected to total $4.4 trillion in 2022, an increase of 4% from 2021, according to the latest forecast by Gartner, Inc.

“This year is proving to be one of the nosiest years on record for CIOs,” said John-David Lovelock, distinguished research vice president at Gartner. “Geopolitical disruption, inflation, currency fluctuations and supply chain challenges are among the many factors vying for their time and attention, yet contrary to what we saw at the start of 2020, CIOs are accelerating IT investments as they recognise the importance of flexibility and agility in responding to disruption.

“As a result, purchasing and investing preference will be focused in areas including analytics, cloud computing, seamless customer experiences and security.”

Inflation impacts on IT hardware (e.g., mobile devices and PCs) from the past two years are finally dissipating and are starting to spill over into software and services. With the current dearth of IT talent prompting more competitive salaries, technology service providers are increasing their prices, which is helping to increased spending growth in these segments through 2022 and 2023. Software spending is expected to grow 9.8% to $674.9 billion in 2022 and IT services is forecast to grow 6.8% to reach $1.3 trillion (see Table 1).

Table 1. Worldwide IT Spending Forecast (Millions of US Dollars)

| 2021 Spending | 2021

Growth (%) |

2022 Spending | 2022

Growth (%) |

2023 Spending | 2023

Growth (%) |

|

| Data Centre Systems |

207,306 |

6.7 |

218,634 |

5.5 |

230,385 |

5.4 |

| Software | 614,494 | 15.9 | 674,889 | 9.8 | 754,808 | 11.8 |

| Devices | 809,452 | 16.1 | 824,600 | 1.9 | 837,844 | 1.6 |

| IT Services | 1,185,103 | 10.6 | 1,265,127 | 6.8 | 1,372,892 | 8.5 |

| Communications Services |

1,443,419 |

3.4 |

1,448,396 |

0.3 |

1,477,798 |

2.0 |

| Overall IT | 4,259,773 | 9.5 | 4,431,646 | 4.0 | 4,673,728 | 5.5 |

Source: Gartner (April 2022)

The rise of enterprise application software, infrastructure software and managed services in the near and long term demonstrates that the trend toward digital transformation is not a one- or two-year trend, rather it is systemic and long-term. For example, infrastructure as a service (IaaS) underpins every major consumer-focused online offering and mobile application, accounting for a significant portion of the almost 10% growth in software spending in 2022.

Gartner expects digital business initiatives such as experiential end-consumer experience and optimisation of supply chain to push spending on enterprise applications and infrastructure software into double-digit growth in 2023.

The Russian invasion of Ukraine is not expected to have a direct impact on global IT spending. Price and wage inflation compounded with talent shortages and other delivery uncertainties are expected to be greater impingements on CIOs’ plans in 2022 but will still not slow down technology investments.

“CIOs anticipate having the financial and organisational ability to invest in key technologies throughout this year and next,” said Lovelock. “Some IT spending was on hold in early 2022 due to the Omicron variant and subsequent waves but is expected to clear in the near-term.

“CIOs who keep their eye focused on key market signals, such as the shift from analogue to digital business and buying IT to building it, as well as negotiate with their vendor partners to assume ongoing risks, will fare better in the long-term. At this point, only the most fragile companies will be forced to pivot to a cost cutting approach in 2022 and beyond.”

More detailed analysis on the outlook for global IT spending is available in the Gartner webinar “IT Spend Forecast, 1Q22 Update.“ Learn about the top priorities for CIOs in 2022 in the complimentary Gartner e-book 2022 Leadership Vision for Chief Information Officers.

Gartner’s IT spending forecast methodology relies heavily on rigorous analysis of the sales by over a thousand vendors across the entire range of IT products and services. Gartner uses primary research techniques, complemented by secondary research sources, to build a comprehensive database of market size data on which to base its forecast.

The Gartner quarterly IT spending forecast delivers a unique perspective on IT spending across the hardware, software, IT services and telecommunications segments. These reports help Gartner clients understand market opportunities and challenges. The most recent IT spending forecast research is available to Gartner clients in “Gartner Market Databook, 1Q22 Update.” This quarterly IT spending forecast page includes links to the latest IT spending reports, webinars, blog posts and press releases.

Fachartikel

Studien

Cloud-Transformation & GRC: Die Wolkendecke wird zur Superzelle

Threat Report: Anstieg der Ransomware-Vorfälle durch ERP-Kompromittierung um 400 %

Studie zu PKI und Post-Quanten-Kryptographie verdeutlicht wachsenden Bedarf an digitalem Vertrauen bei DACH-Organisationen

Zunahme von „Evasive Malware“ verstärkt Bedrohungswelle

Neuer Report bestätigt: Die Zukunft KI-gestützter Content Creation ist längst Gegenwart

Whitepaper

Unter4Ohren

Datenklassifizierung: Sicherheit, Konformität und Kontrolle

Die Rolle der KI in der IT-Sicherheit

CrowdStrike Global Threat Report 2024 – Einblicke in die aktuelle Bedrohungslandschaft

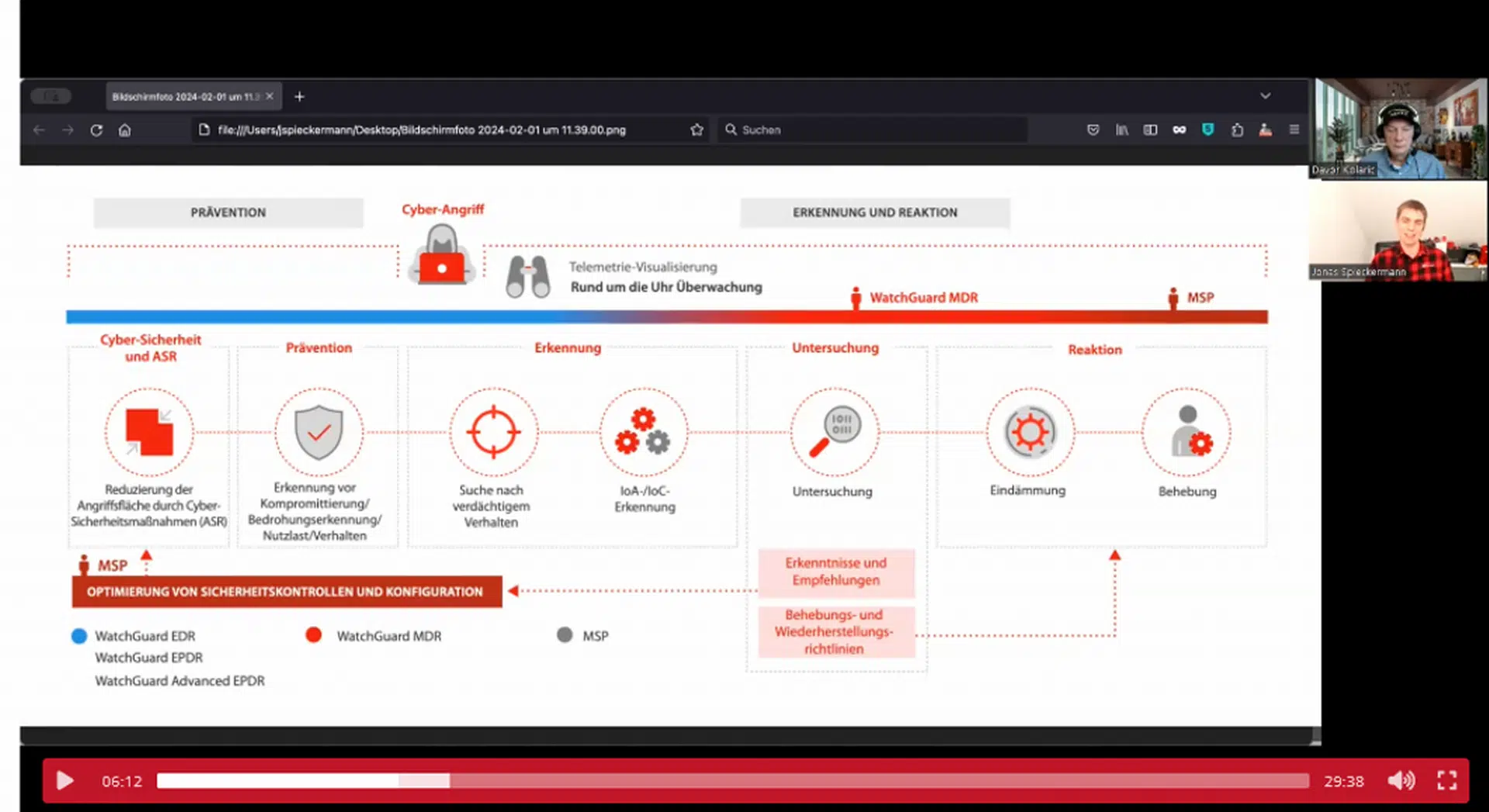

WatchGuard Managed Detection & Response – Erkennung und Reaktion rund um die Uhr ohne Mehraufwand