Reposify’s external attack surface management (EASM) capabilities expand CrowdStrike’s robust Threat Intelligence and Security and IT Operations product suites

CrowdStrike Holdings, Inc., a leader in cloud-delivered protection of endpoints, cloud workloads, identity and data, today announced it has agreed to acquire Reposify Ltd. Reposify provides an external attack surface management (EASM) platform that scans the internet for exposed assets of an organization to detect and eliminate risk from vulnerable and unknown assets before attackers can exploit them. With Reposify, CrowdStrike will provide a fundamentally differentiated EASM experience to customers as part of its world-renowned Threat Intelligence product suite, combining deep insights on endpoints and IT environments with internet scanning capabilities that deliver an adversarial-view of organizational risk across internal and external attack surfaces. CrowdStrike will also leverage Reposify’s capabilities to bolster its rapidly growing Security and IT Operations product suite.

Attack surface management is a critical aspect of the broader enterprise security posture. Understanding where shadow IT, legacy systems and unknown infrastructure exposes enterprises to additional risk is essential to enhance the overall security stance of organizations.

“Fortifying security posture and reducing enterprise risk are top priorities for organizations. Traditional risk models take an inside-out approach, which doesn’t always account for how a threat actor may view the external attack surface. Reposify’s technology delivers an outside-in perspective of an organization’s global external risk, providing deep visibility into what connected devices are vulnerable and most likely to be targeted,” said George Kurtz, co-founder and chief executive officer of CrowdStrike. “Combined with CrowdStrike’s industry-leading threat intelligence and ITSecOps offerings, this acquisition will provide customers an adversarial view of their external-facing risk and vulnerabilities so they can be more proactive in managing their security posture and more resilient to attacks.”

“We couldn’t be more excited to be joining the peerless team and industry-leading innovators at CrowdStrike,” said Uzi Krieger, chief executive officer of Reposify.

Reposify was founded by Yaron Tal in 2017 to help organizations take control of their external attack surfaces by providing complete and continuous visibility and actionable insight at scale. Their core technology leverages one of the largest databases of internet-facing assets to empower organizations with the most complete view of their external attack surface with just a click of a button. In March 2021, Gartner named Reposify to its 2021 emerging vendors list in the external attack surface management security category. This annual list showcases rising technology vendors that are spearheading the future success of cyber innovation.

“We built Reposify to enable organizations on a global scale to have visibility into the unprotected assets from the vantage point of attackers, and look forward to integrating our groundbreaking technology into the world-class CrowdStrike Falcon platform,” said Yaron Tal, founder and chief technology officer of Reposify.

Related Content

Watch the Fal.Con 2022 keynote of CrowdStrike’s co-founder and chief executive officer, George Kurtz.

Watch the Fal.Con 2022 keynote of CrowdStrike’s chief technology officer, Michael Sentonas, to learn about how Reposify will enhance the CrowdStrike Falcon platform and read the blog post.

Transaction Details

The purchase price will be paid predominantly in cash, with a portion delivered in the form of stock and options subject to vesting conditions. The proposed acquisition is expected to close during CrowdStrike’s fiscal third quarter, subject to customary closing conditions.

Fachartikel

Studien

Cloud-Transformation & GRC: Die Wolkendecke wird zur Superzelle

Threat Report: Anstieg der Ransomware-Vorfälle durch ERP-Kompromittierung um 400 %

Studie zu PKI und Post-Quanten-Kryptographie verdeutlicht wachsenden Bedarf an digitalem Vertrauen bei DACH-Organisationen

Zunahme von „Evasive Malware“ verstärkt Bedrohungswelle

Neuer Report bestätigt: Die Zukunft KI-gestützter Content Creation ist längst Gegenwart

Whitepaper

Unter4Ohren

Datenklassifizierung: Sicherheit, Konformität und Kontrolle

Die Rolle der KI in der IT-Sicherheit

CrowdStrike Global Threat Report 2024 – Einblicke in die aktuelle Bedrohungslandschaft

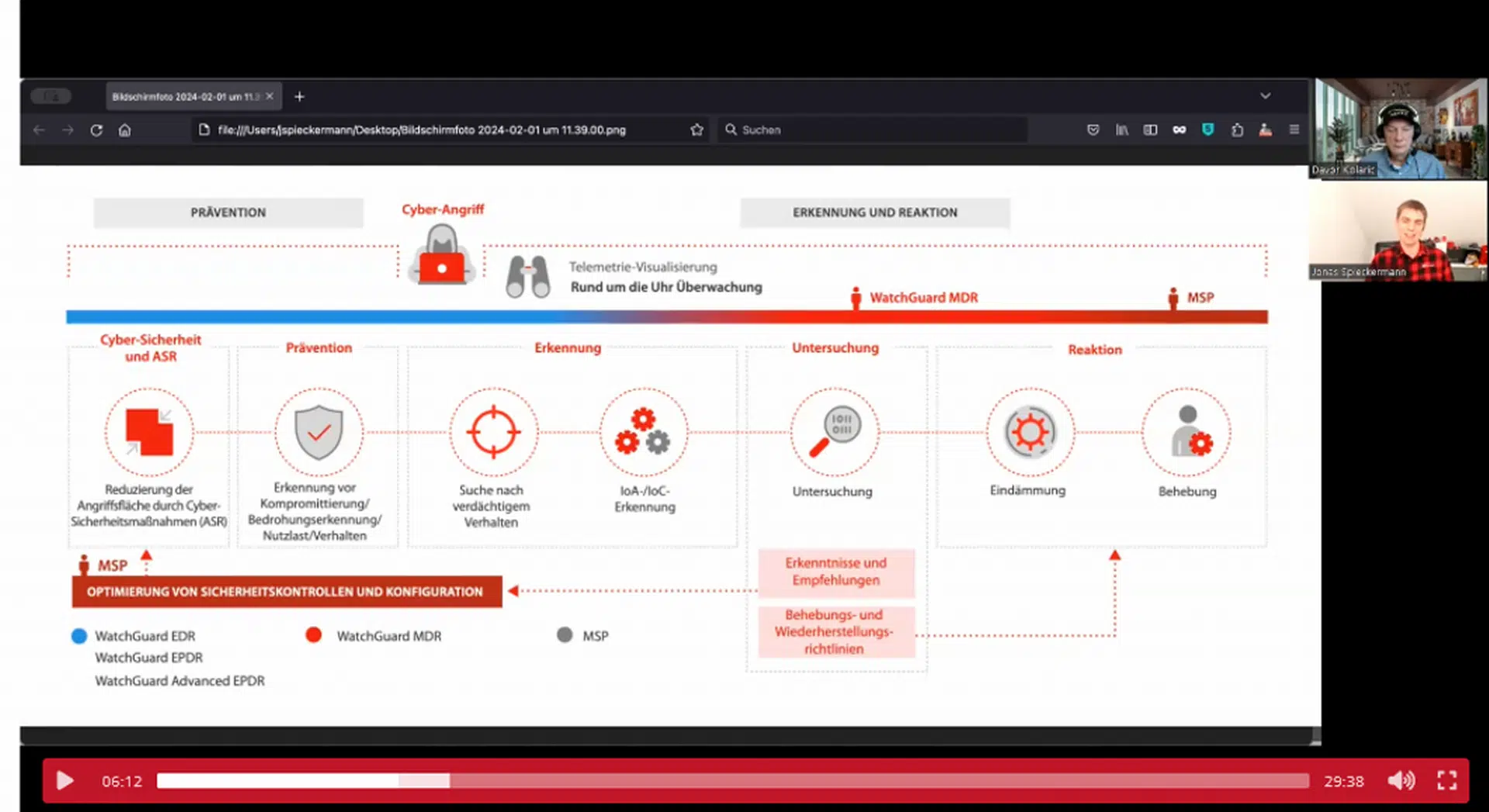

WatchGuard Managed Detection & Response – Erkennung und Reaktion rund um die Uhr ohne Mehraufwand